Other branches of accounting include managerial, tax, and nonprofit accounting. As the name suggests, the statement of cash flows is a report that tracks cash coming in and out of a business during a period of time. Stakeholders use this report https://1investing.in/accounting-for-law-firms-a-guide-including-best/ to determine how well a business manages its cash. Balance sheets are used by investors, analysts, and shareholders to help assess a firm’s financial standing. As it’s a snapshot, it doesn’t show trends or changes over a period of time.

The process of financial accounting begins with the recording of transactions in the company’s accounting system. Transactions can include sales, purchases, payments, receipts, and other financial events. These transactions are recorded using the double-entry accounting system, which ensures that every transaction has an equal debit and credit entry. The focus of financial accounting is outward – its work product is read by persons outside of a business, such as investors, creditors, and lenders.

Who are all the users of financial accounting?

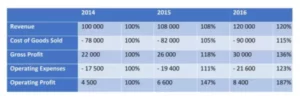

In the U.S. there are several standard-setting bodies that contribute to GAAP, aiming to create independent guidelines that lead to relevant, reliable, and non-biased financial reports. Financial accounting is just one branch of accounting, used primarily to report information to parties outside of the company, such as external stakeholders. One of the biggest benefits of reporting financial data is that it helps analysts and managers understand their business and therefore improve its profitability. For example, a business decides to renovate its offices and the work costs a total of $50,000. It uses $20,000 in cash to pay for it (equity) and $30,000 of debt to pay for the remainder (liability). It includes some very complex standards that were issued in response to some very complicated business transactions.

All transactions for a period are summarized and reported in financial statements. Classification, report formats, and other conventions are applied to ensure that each of the financial statements meets GAAP requirements and can be trusted by external readers. It’s important to become familiar with financial accounting because it’s the most encompassing type of accounting – it’s often referred to as the “official” language of business in the U.S.

New to Business Essentials? Start here.

Grouping of same nature transactions together adds convenience in understanding of information collected. Accounting is the process of keeping track of your business’s financial transactions. Accounting is popularly regarded as “the language of business” because it doesn’t just help you keep track of your money, but also helps you make informed decisions about your business. To speed up action, you may hire accounting professionals or purchase accounting software to ensure accurate financial audits and reporting. Accounting software allows you to do basic tasks such as tracking inventory, invoicing and payments, and generating reports on sales and expenses.

- So to lead you, fair reader, safely into the tedious center of an already tedious trial, Insider has enlisted two accountants — one pro-Trump, one not — both of whom also do stand-up comedy.

- In line with the GAAP (Generally Accepted Accounting Principles), you should record the revenue during the period of sale of goods and services.

- SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments.

- To help track time and automate processes, consider investing in a project management platform like COR.

While you can see total owner’s equity on your balance sheet, this more detailed report can indicate the cause of increases or decreases in owner’s equity. You may also hear the income statement referred to as the profit and loss statement. Liability, revenue, and equity accounts have normal credit balances (i.e., crediting these types of accounts increases them). Work https://www.wave-accounting.net/the-best-guide-to-bookkeeping-for-nonprofits/ opportunities for a financial accountant can be found in both the public and private sectors. A financial accountant’s duties may differ from those of a general accountant, who works for themself rather than directly for a company or an organization. You can outsource your accounting work to outside professionals who specialize in bookkeeping and tax preparation.

Accounting Period Concept

When you document every financial transaction, you gain complete clarity over money in, and money out. This makes it easy to spot fraudulent purchases made on behalf of the organization, which helps prevent heavy financial losses before they happen, not after. In short, this allows finance teams to make strategic decisions to improve operational efficiency and reduce costs. It also ensures a healthy cash flow position and leads to things like investor attraction. General ledger reconciliation is the process of ensuring that the general ledger is in balance. By reconciling all transactions, you ensure that all entries are correctly entered and that your books balance.

It then deducts all matching expenses during the same period and what’s left over is the profit or loss. Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances. Financial accounting is critical because it provides critical information to people who are making important decisions. They’re used by the business to drive directional What is the Average Cost of Bookkeeping Services for Non-Profit Agencies? decisions or by outside parties considering investing in the business. Since such important decisions are based on this information, financial accounting documents are strictly regulated and required by law in the United States. The statement of retained earnings shows the amount of earnings the company has accumulated and kept within the company since inception.

What the heck, generally, is GAAP?

It means that the revenues and any other affiliated expenses should be recorded during the same accounting period. The cost principle is a financial accounting principle that records short and long-term assets at the amount they are worth (cash amounts). It entails that the accounting officer will record transactions at the specific time they occurred. Financial accounting entails providing the necessary information to third parties outside the organization.